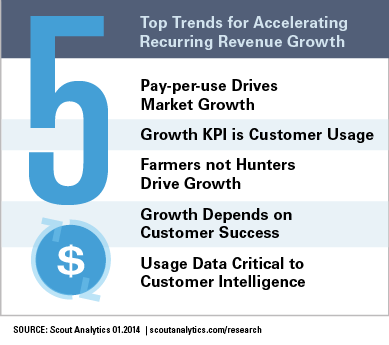

With over 120 customers and more than $3.3 billion under analysis, we get to have a big-picture perspective here at Scout Analytics. We collaborate with our customers continuously on new strategies for accelerating recurring revenue growth, and that’s helped us identify certain trends emerging across industries—common themes that show the potential for tipping-point dynamics. Below are the top 5 trends which we predict will hit a tipping point and start to take hold more broadly in 2014: #1: Pay-per-use will drive market growth When Salesforce.com launched its per-user per-month subscription model, the pricing wasn’t aimed at big enterprises already implementing Siebel or other on-premises software packages. The new model was aimed at the unserved SMB customer segment—and this created huge […]