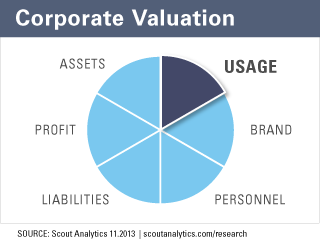

On what basis do you typically value a company and reward its executives? Executives know the criteria: Profit. Assets and liabilities. Brand. People. Customers.

But that’s how executives approach valuation in the traditional supply chain economy. Are those criteria sufficient in the new subscription economy? Consider a growing company like subscription car-sharing service Car2Go. They claim hundreds of thousands of customers, but their revenue is based on the actual car usage of those customers. The valuation question then quickly becomes how  often and how much do their customers use the cars? Is car usage going up or down, and how quickly? It’s the car usage by customers—not the raw customer count—that is the primary driver to revenue, profit, and hence, valuation.

often and how much do their customers use the cars? Is car usage going up or down, and how quickly? It’s the car usage by customers—not the raw customer count—that is the primary driver to revenue, profit, and hence, valuation.

As Scout Analytics works with subscription economy executives, we find again and again this measure of usage is a missing component in building corporate value—and it’s something we’ve come to call Usage Capital™.

In the subscription economy, customer usage is the basis for revenue retention and growth. The reason is simple: Your customer can only get return on investment (ROI) if they use your product or service (as we discussed in our previous research alert). That means the more that a customer uses your product or service, the more ROI they derive. And the more ROI they derive, the more loyal they become and the more products and services they will buy. In other words, you retain and grow your revenue when customers make more use of your product and services.

So what is Usage Capital? Usage Capital is what’s generated when companies put down the jargon-filled customer-satisfaction manual and truly focus on gathering data about how customers use their products and services.

Of course, measures such as active users, average daily usage, frequency of use, and loyalty are not measurable financial assets (i.e., they aren’t reflected on the profit and loss statement), but that doesn’t mean they aren’t without value. These are all measures of Usage Capital and leading indicators for customer-delivered ROI—which means that they have a profound impact on revenue retention and future growth.

If executives and investors only focus on data that reports the current state of affairs—such as MRR, customer acquisition costs, churn, and cost of goods sold—they risk completely overlooking the data asset that can drive future revenue growth. Companies that don’t have visibility into and understanding of customer usage might as well flush the acquisition investment down the drain, because they’ll be flying blind on revenue retention and growth.

The Implication

Customer purchasing has shifted from pay-to-own to pay-to-use—and that means the health and value of your company is based not on customer orders but on customer usage.

The telecommunications industry is often a bellwether for business models in the subscription economy, and we’re already seeing the effects of Usage Capital there, as investors focus more and more on consumption per user and average revenue per user to project company valuations.

Within a couple years, it will be commonplace for venture capital to not only ask for customer reference but also to ask for customer usage data. Why wouldn’t a venture investor want to know, for example, exactly how much adoption each customer has before investing in a company?

The companies that master how to leverage their Usage Capital will be the ones that fuel growth, because these companies will know:

- How to retain customers

- Who is ready for an upgrade

- Who is ready for an add-on

- Where to invest to extend the value proposition

- How to optimize pricing

By knowing and growing your Usage Capital, you hold the keys for retaining and growing your revenue—and thereby maximizing the valuation of your company.

Usage Capital is a trademark of Scout Analytics.