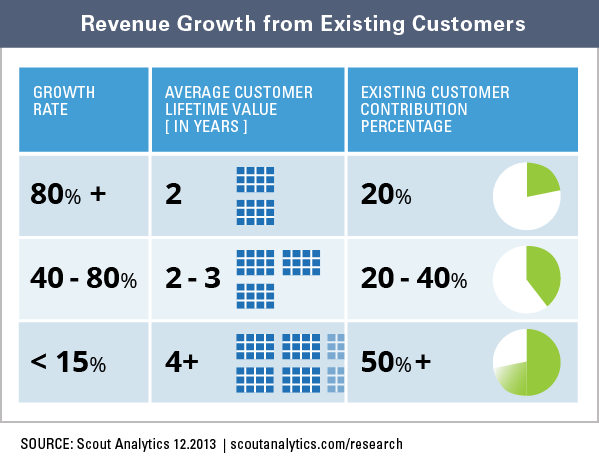

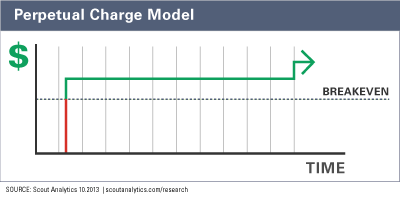

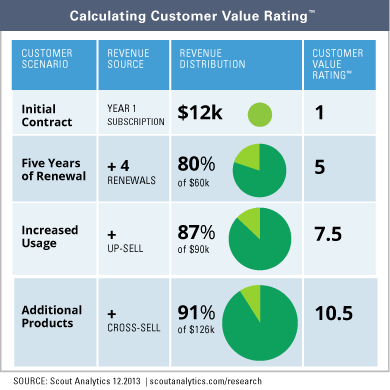

For the vast majority of recurring revenue businesses, existing customers don’t just fuel growth—they represent all of the businesses’ profits. Take the average customer relationship in the SaaS market: it takes 3.14 years to reach profitability, which for a $12,000/year subscription would mean $37,680 to hit breakeven. That means a full 68 percent of the revenue needed to achieve profitability is collected after the initial contract. This means profitability stems first from ensuring customer success and then growing the relationship. That percentage gets higher the further you can extend the lifetime of a customer and as the relationship becomes more profitable. In our research, we’ve found that the most profitable, best-performing companies realize 90 percent or more of a customer’s […]