For the vast majority of recurring revenue businesses, existing customers don’t just fuel growth—they represent all of the businesses’ profits.

Take the average customer relationship in the SaaS market: it takes 3.14 years to reach profitability, which for a $12,000/year subscription would mean $37,680 to hit breakeven. That means a full 68 percent of the revenue needed to achieve profitability is collected after the initial contract. This means profitability stems first from ensuring customer success and then growing the relationship.

That percentage gets higher the further you can extend the lifetime of a customer and as the relationship becomes more profitable. In our research, we’ve found that the most profitable, best-performing companies realize 90 percent or more of a customer’s lifetime value after the initial contract.

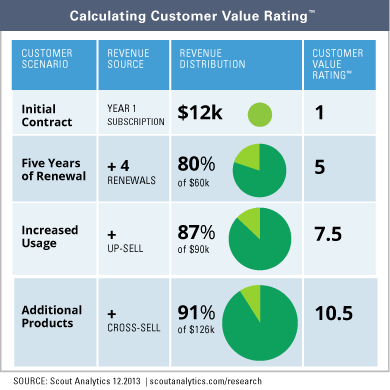

To understand how this percentage can shift, consider another example: If a customer pays $12,000 as the initial contract value for a subscription and then renews every year over a five-year period, 80 percent of the customer lifetime value will have been realized after the initial contract (i.e., $48,000 out of $60,000 total). If the customer’s usage and recurring revenue doubled in a linear fashion during that period of time, nearly 87 percent of the customer lifetime value would have been realized after the initial contract (i.e., $78,000 out of $90,000 total). If the customer had adopted additional products after year two during the period, over 90 percent of the customer lifetime value would have been realized after the initial contract (i.e., $114,000 of $126,000).

Understanding this relationship between recurring revenue and profit gives you a new way to analyze profitability with the benefit of avoiding a full financial analysis. Customer Value Rating™ (CVR) is a metric that correlates customer lifetime value against initial contract value—and it leverages the relationship between recurring revenue and profit as an easy way to benchmark profitability across product lines and customers segments.

To find CVR, simply divide customer lifetime value (i.e., total recurring revenue from a customer over the lifetime of the customer relationship) by the initial contract value (i.e., the recurring revenue from the first contract). The chart to the right demonstrates CVRs calculations for the examples above, with the CVRs being 5, 7.5, and 10.5, respectively.  The higher the average CVR is for a customer segment, the more profitable the business model, assuming the associated ratio of sales and marketing costs stay constant. The best-performing companies in our research (the ones realizing 90 percent or more of a customer’s lifetime value after the initial contract) often had a CVR of 10 or better.

The higher the average CVR is for a customer segment, the more profitable the business model, assuming the associated ratio of sales and marketing costs stay constant. The best-performing companies in our research (the ones realizing 90 percent or more of a customer’s lifetime value after the initial contract) often had a CVR of 10 or better.

Because you can easily calculate CVR for any customer, across products and customer segments, you can compare or average CVRs to understand relative profitability between customers or customer cohorts. You can also use CVR to track a cohort over time, to monitor progress on profitability. CVR essentially lets you identify and benchmark the sources of profitability across a broad range of business parameters without relying on convoluted financial analysis.

The beauty of CVR is that it’s a bi-directional measure: While it provides a relative ranking of profitability (i.e., value to the company), it also provides a relative ranking of customer success (i.e., value to the customer). Customers stay customers because of the value they derive from your products and services. The higher the CVR, the more loyal the customer base, which can help you understand where your customer success initiatives are working.

The Implication

Growing recurring revenue without growing profitability is a leading cause of failure in the subscription economy. For your business to grow, you need to track and use early indicators of profitability to guide investment and initiatives. CVR and similar metrics give you the basis for benchmarking whether you’re creating sustainable profit growth—and CVR helps you identify risks and opportunities early, so you can act on them.

First, you need to be able to measure initial contract value versus customer lifetime value. Second, you need to be able to track changes in customer lifetime and customer lifetime value. Third, you must be able to quickly and easily analyze revenue and profitability in the context of customer lifetime, in order to iterate and improve.

Maximizing customer lifetime is the basis for growing profits in a recurring revenue business. To increase profitability, a company needs to grow the cumulative revenue after the initial contract. By focusing on customer success and understanding when and how to engage your customers with additional offers, you can achieve significant growth objectives.

The companies that can harness customer lifetime data are the ones that will know how to measure and maintain profitability in a predictive fashion.

Customer Value Ratio™ is a trademark of Scout Analytics