With over 120 customers and more than $3.3 billion under analysis, we get to have a big-picture perspective here at Scout Analytics. We collaborate with our customers continuously on new strategies for accelerating recurring revenue growth, and that’s helped us identify certain trends emerging across industries—common themes that show the potential for tipping-point dynamics.

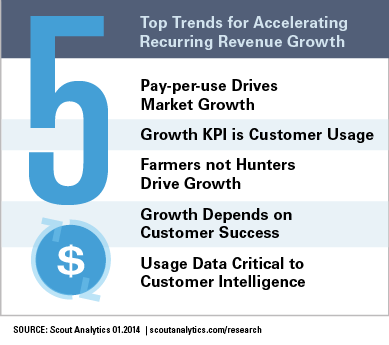

Below are the top 5 trends which we predict will hit a tipping point and start to take hold more broadly in 2014:

#1: Pay-per-use will drive market growth

When Salesforce.com launched its per-user per-month subscription model, the pricing wasn’t aimed at big enterprises already implementing Siebel or other on-premises software packages. The new model was aimed at the unserved SMB customer segment—and this created huge growth in the Salesforce automation marketplace. Likewise, Amazon’s rapidly growing AWS offering was aimed at startups that couldn’t afford their own data centers.

Pay-per-use models extend markets. In 2014, we’ll see growth-oriented companies find even more ways to reach new customer segments with new pricing and packaging that allows customers to only pay for what they use.

#2: The golden revenue KPI evolves from customer count to customer usage

Car2Go and Uber are both emerging recurring revenue businesses, but their revenue models are based on customer usage—so customer count isn’t sufficient for understanding their growth. For example, Car2Go claims over 500,000 customers, but those customers only generate revenue when they’re driving. If you want to understand Car2Go, the most telling metrics involve average minutes per month for those customers and the trend lines for their usage.

In 2014, we’ll see traditional, purchase-based e-commerce KPIs give way to usage and engagement indicators as the cornerstone for successful performance.

#3: Recurring revenue and profit growth will come from the “farmers,” not the “hunters”

For the vast majority of recurring revenue businesses, existing customers don’t just fuel growth—they represent all of the businesses’ profits. Take the average customer relationship in the SaaS market: it takes 3.14 years to reach profitability, which for a $12,000/year subscription would mean $37,680 to hit breakeven. That means a full 68 percent of the revenue needed to achieve profitability is collected after the initial contract.

The key to profitability is ensuring customer success and then growing the relationship. Consequently, we’ll see a shift this year as growth objectives achieve a better balance between the “hunters” and the “farmers,” who will focus on nourishing current customers and maximizing customer lifetime value.

#4: More marketing and sales teams will take a united approach to customer success

Currently, a product is the primary means of customer engagement—but the product usage data is disconnected from the other systems of engagement in a recurring revenue business, such as marketing automation. As a result, marketing, sales, and customer success teams can’t proactively engage customers to create value and grow the relationship. This fragmentation also leads to a siloing of responsibility regarding customer success.

In 2014, more companies will begin to link data from their products directly into marketing, support, billing, and sales systems. This will enable an organizational shift that unites all departments in ensuring customer success.

#5: Businesses will understand that not all data is the same, and that usage data needs to be handled separately

Many recurring revenue businesses already know that the biggest growth opportunities lie in understanding and harnessing usage data—the data behind how customers actually use a product or service. And thanks to the rise of cloud computing, big data, and a growing mobile network of increasingly sophisticated sensors, customer usage data is now more readily available than ever.

But tapping into this new type of data can be complex because of its sheer volume and velocity. In 2014, recurring revenue businesses will begin treating usage data in a completely different way than traditional CRM data, and they’ll place a higher value on dealing with this data separately.