In subscription-based services, revenue comes two sources: customer acquisition and renewal acquisition. Once renewals become more than 50 percent of the revenue, sales and marketing costs associated with the renewal process begin to become a larger factor in managing profitability. The interesting dynamic is that while the acquisition phase occurs once during the lifetime of a customer, renewal acquisition is an annual event. The multiplier effect of reducing renewal acquisition costs can increase customer lifetime profits substantially.

The best way to measure sales and marketing contribution to profits is to measure the ratio between gross-margins generated and the associated sales and marketing costs. So for calculating the customer acquisition cost (CAC) ratio, it would simply be the revenue from new customers divided by the sales and marketing costs associated with those transactions. The renewal acquisition cost (RAC) ratio would be the revenue from renewals divided by the sales and marketing costs associated with renewals.

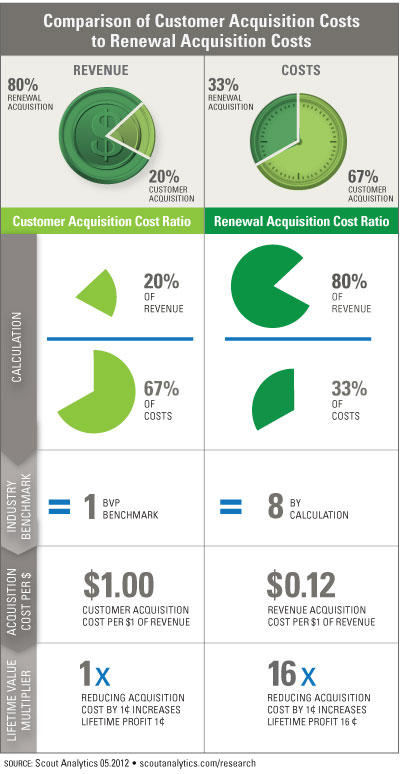

The following infographic compares CAC Ratio and RAC Ratio impact on profits using industry benchmarks from Bessemer Venture Partners. The subscription revenue for this example is comprised of 80% renewal acquisition and 20% customer acquisition. And of the sales and marketing costs, 33% support renewal acquisition while 67% are spent on customer acquisition.

Using the Bessemer Venture Partners benchmark that a successful subscription service needs CAC Ratio > 1, the infographic shows the corresponding RAC Ratio > 8. With these ratios, every dollar of gross margin from a new customer costs $1 to acquire, and from a renewal costs 12.5 cents to acquire.

The infographic then shows the lifetime value multiplier of lowering acquisition costs by 1 cent. The example assumes that the average customer lifetime is five years, in which case there would be an average of four renewal cycles. Reduction of renewal acquisition costs adds an incremental cent of profit per renewal dollar for each year, compared to improving customer acquisition costs, which impacts the profit only in the first year. Additionally, improving the renewal acquisition costs impacts a bigger portion of the revenue – in this case, four times more revenue. The overall lifetime value multiplier is 16, based on four times the transactions and four times the revenue.

Implication

When considering revenue yield and sales productivity initiatives, understanding RAC Ratio vs. CAC Ratio gives you the optics to which initiative will contribute more to the bottom line. Existing customer relationships are an incredible source of revenue and profit growth.