Through 2015, much of the B2B media revenue growth forecasted by Veronis Suhler Stevenson shows a substantial portion will come from events — both live and virtual. Most notably, over 70% of clients are increasing investment in geographical events that can be replicated in multiple locations – geo-cloning, as one client called it. And because events require longer lead times, extensive production and marketing investment, optimizing event revenue becomes dependent on trade-offs – specifically, trade-offs between the revenue potential of various events.

So how do you measure revenue potential of an event? Event revenue mainly comes from two sources: vendors and attendees. In the case of vendors, their revenue directly correlates to the number of attendees to which they gain access. Revenue earned from attendees comes from admission or tickets to the event. While there are other influencing factors, the attendees are one of the biggest, followed by average revenue per user. Consequently, the potential attendees (a.k.a., the current audience) become a key indicator for revenue potential when selecting between events.

The following example illustrates the method for measuring for potential attendees. Suppose a life sciences magazine focusing on clinical trials wanted to capitalize on the new trend of “risk-adapted trials” by hosting a conference. If the publisher needs 500 attendees at the conference and they expect a 0.5% conversion rate from e-mail marketing and on-site targeting, do they have enough audience to confidently plan the event? While the publication and the specific values and the metrics are fictional, the ratios and percentages are based on the average of multiple clients for which we have done this analysis.

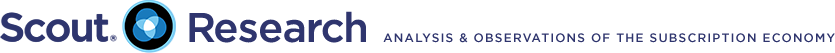

The first step is to find audience members who indicate interest in “risk-adapted trials” by reading about the topic. The second step is to identify which of them are known, registered audience members and which are anonymous (which turns out to be important in conversion rates.) The last step is to identify which of them are members of the loyal audience versus which are fly-bys, as the fly-bys will be almost impossible to attract for another visit.

As shown in the infographic below, finding the “risk-adapted trials” audience means extracting both non-article page views (e.g., home page) and non-risk-adapted-trial article page views.

As a percentage of all the page views, “risk-adapted trials” comprised 11% (58% article views multiplied by 19% risk-adapted article views). In the second step, these risk-adapted-trial article views were then segmented by registered and anonymous users, with registered comprising 13.3% of the article views, and anonymous comprising 86.7%. Finally, the third step identified the loyal audience to whom the conference could be marketed. In the case of registered users, the marketable audience was 15,900 and the anonymous audience was 109,375.

The registered and anonymous audience added together makes a potential audience of 125,275. Promotion at the 0.5% conversion rate would be 626, or 25.2% above the target goal. In reality, the assumption of similar conversion rates of registered and anonymous audience is incorrect. Directly-marketed, registered users convert at a much higher rate. For this example, a conversion rate of only 3% of registered users would make the estimated conversion of audience to attendees to be 1,024 (477 from registered). The event planners can move forward with less risk in their model and a means to create potential upside on the event.

The opposite can also be true. Just because a topic is an up-and-coming trend in the industry does not mean your audience or your brand can capitalize on that trend. It may be that a publisher’s audience does not warrant their investment in an event, even if they could rent or acquire an optimized marketing list. Their risk will be lower and their return higher in finding an existing audience for marketing purposes.

If the event is to be in-person, the analysis can further break the audience down into regions to determine where the event should be held, or in the case of geo-cloning, which locations would be best to host the event. In the case of virtual events, the location information can be used to determine time zones and optimal times for hosting.

The Implication

As publishers move their digital revenue model away from display advertising and into events, measuring the audience becomes increasingly important. Events have more fixed costs and revenue risks compared to digital display advertising. Consequently, sizing and locating the events to correctly match the audience is critical. Over time, the publisher can begin to benchmark the specific conversion rates of different events with the audience, and model even more closely to the revenue potential.