In the Subscription Economy, purchase-to-use is winning, and purchase-to-own is on its way out. Why? It’s simple: We only want to pay for the value we receive from a product or service—and we only receive value when we’re using that product or service.

As the following graphs show, current subscription models could see as much as a 99 percent erosion in revenue based on some usage profiles—unless providers can develop strategies for pricing and customer adoption that prevent that loss.

The evolution from purchase-to-own to purchase-to-use is inevitable, even though it will vary by industry and customer segment. The last research alert http://research.scoutanalytics.com/subscriptions/per-user-per-month-subscriptions-the-first-step-in-changing-customer-behavior/ documented how this trend might evolve in B2B SaaS, while this research alert will show impact to revenue when tying revenue and profits directly to usage.

The following charts demonstrates how different p er-user charge models impact revenue when a user is active only one day per quarter.

er-user charge models impact revenue when a user is active only one day per quarter.

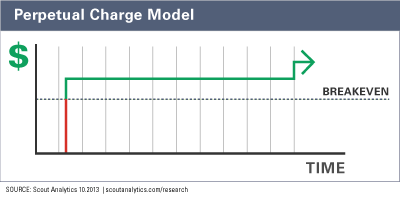

The first charge model is for the increasingly outdated “perpetual license,” where the user pays an up-front charge and a yearly maintenance charge (e.g., 20% of original purchase). This perpetual charge model clearly benefits the provider: the average sale is highly profitable, and the customer is locked in by high switching costs. The customer carries most of the purchase risk.

The second charge model is per-user per-month, which cuts into that upfront cost and allows a customer to pay over time. This model delays breakeven and profitability for the provider (compared to the perpetual charge model), and the customer can pay for what they expect to use, adding or deleting users as business requirements change. The purchase risk is shared more equally in this model, but in many cases the customer still bears the majority of the risk (e.g., making a multi-year commitment to a set of monthly users).

The third charge model is per-active-user per-month, which truly flips the risk to the provider. In the example, the charge model starts to change radically: Now rather than simply figuring out how to translate the perpetual user licenses into a monthly per-user payment model, revenue becomes directly dependent on usage. If the user is active only one day per quarter, revenue for that user would suddenly drop from twelve months of charges down to four months.

The fourth and fifth charge models show revenue going down even more dramatically. In a per-week charge model, revenue would be cut by 92 percent. In a per-day charge model, revenue would drop by 99 percent.

The Implication

Think about it: would you pay a utility bill that didn’t show usage information? That kind of transparency is expected now, and it’s here to stay—thanks to the cloud, mobile, and sensors. And customers will migrate towards services and products that provide transparency and only charge for usage.

To succeed, product and service providers must make customer usage a central part of their operations, because:

- Pricing based on value attracts customers and revenue

- Faster onboarding accelerates revenue

- Faster adoption grows revenue

- Keeping users engaged retains revenue

In the Subscription Economy, the future is clear: delivering value drives revenue. Rather than accept 99 percent less revenue (such as in the scenario above), a successful provider will figure out how to price and package usage, and then foster that usage in each of its customers.