There are many reasons to have a “standard” process for customer on-boarding, adoption, renewal, and the other phases of the customer lifecycle. But the truth is that every customer and user is unique—and if you’re only following a standardized process, you’re leaving revenue and profit on the table. The best approach is to define a standardized process for these phases, but then to proactively monitor and manage exceptions.

What is exception management? Exception management is identifying predictive triggers that signal when a customer is off-track from a successful customer journey and then proactively engaging that customer to bring them back on track.

We’ve seen with our own customers how this kind of exception management can have a direct, measurable impact on revenue and profit. One of our customers was recently performing a technology refresh of their subscription service, which has more than 1,200 businesses as customers and many, many individual users. With the refresh, the user interface was completely redesigned, and the functionality was substantially changed and improved—and the newer service also had a planned price increase, so the company had an added incentive to expedite adoption.

The customer success team had identified key milestones in the customer journey for adoption of their products. The team had also developed materials and programs for guiding customers and users through these milestones, assuming that most users could get started and active by themselves. The company planned and budgeted for a six-month conversion based on previous experience, but here is what happened:

For the first time, the team was now tracking user activity and had implemented an exception management process to track where user adoption did not meet the milestone criteria and one-to-one intervention would be needed.

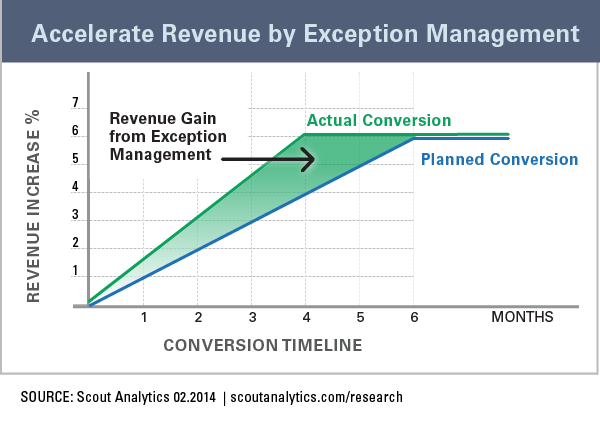

Because the customer success team could now monitor and manage exceptions (i.e., users who weren’t tracking to defined milestones), full conversion was completed in four months rather than the predicted six. This lowered the cost of conversion by a third, and it also brought in the increased revenues from the new pricing by two months. The net increase in revenue after the conversion was more than 6%.

Overall, exception management increased the company’s yearly revenue by a full percentage point, while also reducing costs—that is, an extra 6% revenue over two months averaged into the entire year.

As shown in the chart below, the planned conversion (blue line) was a full six months before all revenue increases were realized. The actual conversion timeline shown in green delivered the revenue increase two months earlier. The area between the two lines represents the growth in revenue and profit from successful exception management.

The Implication

If you build a process for customer success based on the lowest common denominator of customer competency, you’ll build a gold-plated, ultra-high-touch process that ensures even the most regressive customer is successful—so you’ll have high retention but with a high cost. If you build a customer success process that’s streamlined and low touch, assuming each customer has high competency, you’ll lower costs but your retention rates will drop. The trick is to blend these two models through exception management.

Mapping your customer’s journey and understanding the key milestones allows you to predict when a customer is off track—and it also allows you to proactively, efficiently engage the right customer with the right play at the right time.

There are many examples of how tracking user activity can drive successful exception management, including when and why to conduct business reviews and how to manage a renewal process. But the most important takeaway is understanding how exception management contributes directly to revenue and profit growth—and that makes exception management one of the best business cases for customer success management.