In the subscription economy, cost of delivery matters in setting prices, but the factor that’s quickly becoming dominant is value delivered.

As described in the book B4B: How Technology and Big Data Are Reinventing the Customer-Supplier Relationship, customers increasingly want to pay for outcomes, or “realized value.” This customer bias for value-based pricing is just a further extension of the overall movement from pay-to-own to pay-to-use—and companies need to shift their pricing to keep up with this shift in purchase behavior.

Our research recently uncovered an especially good stage in the customer lifecycle to address this value-based mindset: annual price increases on first-year renewals.

Annual price increases are common in B2B subscriptions. Companies need to account for cost of delivery dynamics like inflation, and they typically identify an average price increase needed to maintain gross margins and quality of service.

But as you’ll see, an annual price increase should be an internal guide—not a one-size-fits-all number for all customers.

We studied renewal dynamics of annual price increases across many companies, and a trend emerged: First-year customer renewals have significantly more resistance to annual price increases than do tenured customer renewals.

If you think about it from a value-based pricing perspective, the resistance makes intuitive sense: First-year customers don’t get the same amount of value from a product as tenured customers do, because first-year customers have to onboard and adopt the product to gain value.

Ideally, that onboarding and adoption process is very short, but the standard in B2B subscriptions is in the 90-day range. Compare that to tenured customers, who are getting value from day one of their renewing subscription because they didn’t have the same onboarding and adoption steps to complete.

In our research, we identified a B2B SaaS provider of lead analytics that had created a particularly successful approach to value-based annual price increases.

Historically, the company had used a standard price increase for all renewals, regardless of tenure. But what they found was a higher churn rate amongst first-year customers up for renewal compared with tenured customers.

In an effort to reduce churn on first-year customers, they decided to implement a value-based pricing scheme: The strategy was to scale the price increase based on the value derived during the first year compared to the average value derived from tenured customers.

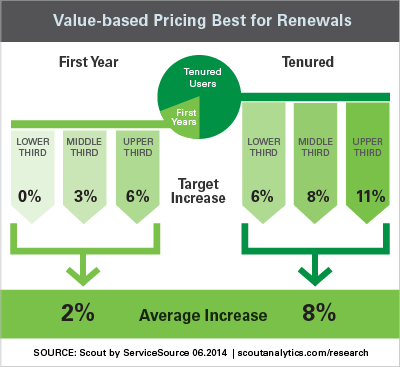

The internal goal was to achieve an overall 6% price increase from all renewals, but the customer target was an average 3% increase for first-year renewals, and an average 7% increase for tenured renewals. Each cohort of first-year and tenured customers was segmented into thirds based on usage (i.e., lower third, middle third, upper third), and the combination of usage ranking and tenure decided the target price increase.

When the account manager met with each first-year customer, they would present the standard price increase but then also show a discount based on amount of time to go live.

As the diagram shows, first-year customers had a target price increase of zero to 6% depending on the value derived in the first year. The actual average price increase was 2%—which was below the target, but the first-year churn rate dropped by more than 10%.

On the other hand, tenured customers had a target range of 6% to 11% depending on the value derived in the previous year. The tenured customer on average renewed with an 8% price increase.

In the end, the company improved both their renewal yield and their retention rate—two important factors for growth.

The Implication

Customer purchasing behavior continues to change, and derived value is becoming even more important. If you want to create customers for life, you need to focus on value-based pricing throughout the customer lifecycle. Knowing your value proposition, measuring value delivered, and pricing accordingly will be critical to growth.