The Subscription Economy is fundamentally changing customer purchase behavior — it is teaching customers to only pay for what they actually consume. The popular per-user-per-month subscription model used by software as a service (SaaS) is only a first step. The true realization of utility computing as a revenue model is still on the way, and the providers that understand monetizing usage are the ones that will thrive.

We are still in the early stages of the Subscription Economy. Many products from information and media to SaaS are being sold on a per-user-per-month model that create revenue with or without product usage. In B2B SaaS subscriptions, Gartner continues to warn of shelfware-as-a-service. A startup called Applango claims 30% of subscriptions are unused in the enterprise. Another startup Katepano is launching a product to help solve the B2B SaaS utilization problem. And it is not limited to just B2B. In B2C, BlinkBox, a Tesco company, reported that more than three quarters of UK consumers have unused subscriptions. These statistics and trends show that the Subscription Economy still has a long way to go in terms of efficiency and customer value.

So how customer purchase behavior evolve? Whether your product is software, information, media, or something else, your customers will increasingly have more information to make better purchase decisions. The increasing flow of information about their usage will change their buying behavior. The following five step transformation of B2B SaaS is just one example of how buying behavior and recurring revenue models will change.

Step One

Salesforce.com famously pioneered the era of SaaS where companies did not have to pay for high up-front capital expense of on-premise software. The value proposition was extensive because it not only addressed software costs but also hardware and administration costs. In the end the beauty of the model was that the buyer could increase or decrease seat counts to Salesforce.com based on actual needs to efficiently pay for what they are actually using. This is in stark contrast to purchasing on-premise software to match your peak needs only to reduce requirements overtime but not up-front purchase costs or maintenance costs. This was the first step in teaching customers to only pay for what they actually use.

Step Two

Just as CIOs looked for solutions to shift spending from high and varying capital expense of on-premise software to more constant and predictable operating expense with Cloud solutions, they will look for solutions to optimize spending on these subscriptions. In response, startups will build solutions to help identify spending optimizations (e.g., Applango and Katepano). Their goal will be to target the 30% of unused SaaS subscriptions in the enterprise. These types of tools will allow CIOs to better manage their purchases with SaaS providers.

Another scenario creating visibility for CIOs will be the need of SaaS providers to supply usage data for security and compliance audits. With these audit logs, utilization audits will become easy, and utilization will become transparent. The new tools and data sources will make it more efficient for CIOs to control their spending with each SaaS provider.

Step Three

And rather than rely on a third-party to deliver usage information or in response to audit requirements, the SaaS provider will start to provide more information on usage as a value-added services. The new transparency will create new requests for changes in subscription charge models. This will lead SaaS providers to offer more flexibility in their rate plans. For example, SaaS providers will start to allow subscriptions to be put on hold when employees are on leave or vacation — just like putting your newspaper subscription on hold. The SaaS provider might offer different per user rates for employees based number of workdays for their domicile country. Maybe, the provider will only charge for activated accounts rather than purchased accounts.

Step Four

CIOs will start to request new usage-based charge models for part-time and temporary users. In response, SaaS providers will come up with rate plans that do not cannibalize existing seat rate plans such as charging per active month of a user. The benefit to the SaaS provider in the short term is an increase in revenues from previously unserved users. There is a longer term effect however.

Step Five

CIOs start to request charge models based on usage for all users.

The Implication

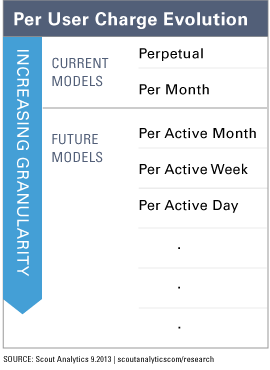

The Subscription Economy is ushering in new levels of transparency as demonstrated by the scenario above. As pictured in the figure to the right, most business models have simply moved from perpetual to per contracted user per month, but that will change. The increasing transparency will align the customer and the provider on the need to deliver value. Customers of course will align to any scheme that links payment to usage and value. For their part, providers will be highly incented to accelerate on-boarding, foster adoption, and encourage utilization because each activity directly drives revenue.

Whether it is B2B SaaS or B2C music streaming, subscription providers cannot escape the need to track and understand customer usage as it relates to purchase and renewal behavior. The ones who do will figure out how to create value and control the charge models of the future. The ones who do not will be left behind.