In the book “Consumption Economics,” the authors describe a phenomenon called the “consumption gap” which is essentially the difference between a product’s capability and what a customer actually uses. The authors point out that this consumption gap will be a catalyst for technology business failures in the Subscription Economy. But how does a company know if they have a consumption gap? How do they quantify it? And how do they avoid revenue churn because of the gap?

Step 1: Measure the Gap

To evaluate if you have a consumption gap, you need to measure and quantify it. That means you need to take inventory on your product’s capabilities and how much a particular customer uses them. For offering, the most straightforward measurement is price. The more features a product provides, the more a business can and will charge. Customer usage can be directly measured using a variety of metrics associated with consumption, such as number of transactions, number of data look-ups, number of active users, etc. The gap is therefore measured as the difference between usage (i.e., value received) and subscription price.

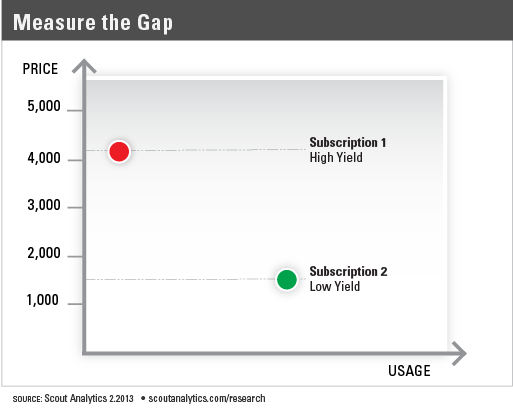

But since usage is not a monetary metric like price, how do you calculate the difference? The answer is yield. Yield is a calculation that combines price and usage into a ratio to provide revenue per unit of customer fulfillment (e.g., revenue per seat mile in the airline industry). Yield then provides interesting insights. Figure 1 shows a yield chart where usage is measured on the horizontal axis in units of usage and price is measured on the vertical axis in dollars. Any customer’s subscription can be mapped into this chart. As shown by Subscription 1 when yield is too high (i.e., low usage compared to high price), the subscription is overpriced compared to customer usage meaning there is a consumption gap and renewal risk. As shown by Subscription 2 when yield is too low (i.e., high usage compared to low price), the subscription is underpriced compared to customer usage meaning there is an excess rather than a gap in value and a revenue opportunity is available.

The following is a real example from a SaaS company that is a customer. The data is blinded but shows how the consumption gap impacts revenue and how yield is a good predictor. In this SaaS example, the most important usage metric is active users. Other SaaS companies have used ‘number of transactions’ or ‘number of artifacts,’ but in this case the right metric was ‘number of active users.’ Figure 2 illustrates the correlation of customer renewal behavior to yield. Revenue growth came when yield per active user was about $1,500 (i.e., customer is getting good value and wants more), and revenue churn occurred when the yield went toward $3,000 (i.e., customer was not getting good value for the price paid).

Step 2: Mind the Gap

Making sure the yield from each subscription is “just right” is the basis of recurring revenue management, and is essential to ensuring success in the Subscription Economy. Recognizing which customer needs help increasing usage can curtail revenue churn. Knowing which customer is an up-sell candidate creates revenue growth. Overall, understanding yield allows a subscription-based business to offer the right subscription, to the right customer, at the right price, at the right time. Realizing yield management enables subscription based companies to avoid the consumption gap and maximize customer lifetime value.