This is the third research alert in a series on pricing. One alert examined why metering access maximizes revenue. The other examined ways in which metering could be effectively applied through tiering at the user level. This research alert examines how to benchmark and manage yield across your license structure, and specifically with site licenses that blend users and discounting.

Site licenses give customers unlimited use of a service while paying a flat, discounted price. The customer motivation to buy site licenses is that it makes purchasing decisions easier than trying to determine which users need which licenses. Another customer motivation for site licenses is that it makes on-going administration easier than trying to manage users and license allocations.

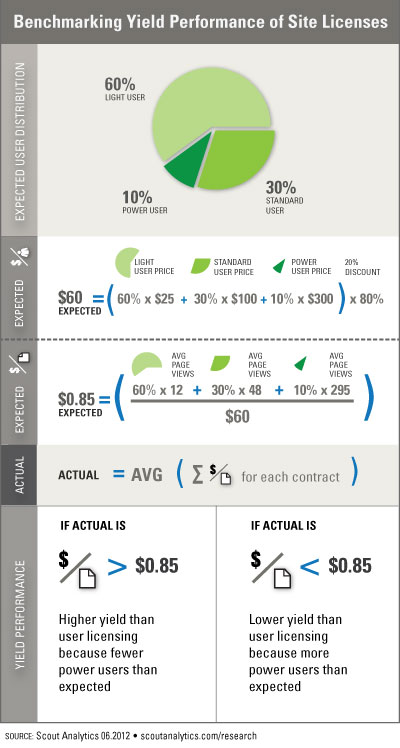

For publishers, site licenses create a problem because of the sizeable risk of lowering yield if the license design and negotiated price don’t accurately reflect actual usage. To evaluate the yield performance of pricing for site licenses, the actual yield can be benchmarked against the expected yield and then used to drive adjustments to pricing for yield improvement. The following infographic explores this further.

Assume that an information publisher has created a site license based on company size that is comprised of a mix of 60 percent light users, 30 percent standard users, and 10 percent power users. Further  assume that the license includes a 20 percent volume discount. In this scenario, the expected price per user would be a weighted by the blend of users; or in this case, $60 per user, as shown by the infographic. The expected yield for the license can be calculated by determining the expected page views per user (i.e., a weighted average of page views) and dividing by the expected price per user. For this example, the expected yield is $0.85 per page view.

assume that the license includes a 20 percent volume discount. In this scenario, the expected price per user would be a weighted by the blend of users; or in this case, $60 per user, as shown by the infographic. The expected yield for the license can be calculated by determining the expected page views per user (i.e., a weighted average of page views) and dividing by the expected price per user. For this example, the expected yield is $0.85 per page view.

To benchmark performance, the expected yield can be compared to the actual yield, which is simply the average of the price per page view of the existing contracts. If the actual price per page view is lower than the $0.85 expected yield, the power user population, or the total user population, is more than expected. Each publisher will need to identify what they are willing to accept in terms of disparity between actual and expected, but if the disparity is too high, the site licenses are underpriced and should have a price increase.

Alternatively, if the actual price per page is higher than the $0.85 of expected yield, the power user population or total user population is lower than expected. In this case, the question is whether the site license is overpriced or whether individual user licenses are underpriced. Further analysis on churn rates by license can indicate where there is opportunity to optimize price and revenues.

The Implication

Maintaining consistent yield across your license structure ensures that customers receive appropriate return-on-investment, regardless of license purchased. Maintaining consistent yield also ensures optimal revenue performance of the license structure. Obviously, there are external factors such as competition or historical customer contract data that influence when and how pricing can be changed to manage yield, but those factors don’t eliminate the importance of building and implementing a data-driven strategy to improve yield from license structure and price levels.