In subscription-based business models, maximizing customer lifetime value is understood to be a key success factor to a profitable business. But how do you know at what point a customer relationship turns profitable? While there are obvious differences between customers, it turns out you can calculate your average customer lifetime to reach the breakeven point using your existing operating metrics. So how is this done?

Here are the standard operational metrics known by every online service:

- Customer Acquisition Ratio (CACR) – the sales and marketing costs to sign up a new customer as a ratio to revenue acquired

- Customer Renewal Cost ratio (CRCR) – the sales and marketing costs of closing a renewal as a ratio to revenue renewed

- Research and Development ratio (RD) – the cost to invest in and make improvements to the service as a ratio to revenue

- Gross Margins (GM) – revenues minus the costs associated with hosting a service and providing customer support

- General and Administrative ratio (GA) – the cost associated with finance, management, and other functions as a ratio to revenue

- Churn Rate (CR) – the percentage of revenue not renewed at the end of a subscription term

- Profit Margin (PM) – the percentage of revenue that are profits

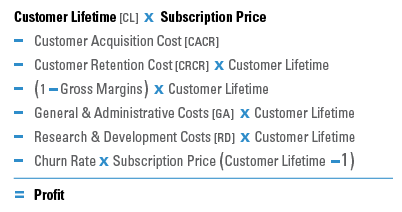

With these operational numbers, the profitability of a customer relationship can be calculated as the total lifetime subscription revenue minus the total costs. The total subscription revenue would be the number of subscription terms multiplied by the subscription price, minus any churn. The total cost would be the customer acquisition costs, customer retention costs, and prorated G&A, R&D, and operational costs. Expressed as a calculation, it would appear as follows:

As demonstrated by the calculation, the total number of terms (i.e. CL, or customer lifetime) is critical to profitability. The equation can be turned into operational metrics by dividing by subscription price to create ratios of each cost in relation to revenues. The result is the following equation:

So by digging out the old math knowledge, solving the average customer lifetime to the breakeven point can be done using the following equation:

At breakeven, profit margin (PM) equals zero which allows the equation to be solved.

The Implication

Knowing your breakeven point on customer relationships enables you to identify the source of profits. You can segment customers quickly into profitable and unprofitable categories. With that segmentation, you can identify what drives profitability and what are leading indicators of churn. In other words, you can optimize your revenues and profits. Scout Research is developing a customer relationship calculator and benchmarking tool for use on our site, which will perform these calculations for you. Look for an announcement in the near future on the availability of the calculator.