In my most recent benchmarking project, I asked a series of B2B digital media brands if they had a behavioral database that the editorial, audience development and sales could use. All of them responded “no,” which means they are not able to operationalize behavioral targeting. This was surprising, as behavioral databases are required to answer such questions as:

- Which audience members read the latest news on a particular topic?

- What news is the most popular for which audience members?

- Which audience members read a vendor guide or some other directory?

- Which audience members are researching information on a specific type of product?

Answering these questions allows media companies to behaviorally target editorial that drives audience engagement, to behaviorally target metering to increase registrations, and to behaviorally target offers to increase event attendance. A behavioral database increases revenue – and that is why the result of the benchmark was so surprising.

A behavioral database tracks what each member of the audience does. A behavioral database also allows media staff to search and answer questions such as those posed above. How many articles did a particular audience member consume? What type of articles? On what topic? How frequently? Is the audience member in market?

In the benchmark, my loose definition of “use” was that the media staff could search directly or through another staff member and the answer would be available within 24 hours. The digital media brands in my benchmark specifically represented mainstream B2B publishers rather than the leading innovators that already have these capabilities. Out of 20 digital media brands, none of them had a behavioral database. It does not mean they didn’t have behavioral data, since almost everyone has weblogs. It means they had no operational use of behavioral data for targeting within editorial, audience development, event marketing or advertising sales.

The odds of my benchmark reporting only anomalies are astronomically low – the same odds of flipping heads 20 times in a row.

If you are a digital media publisher, how would you answer that question? Do you have a searchable, analyzable and reportable behavioral database? Can you query a behavioral database on demand to find out which of your audience are “in-market” (e.g., reading product evaluation guides) for which products?

Managing the market to optimize revenue

Part of the reason for the lack of behavioral databases can be attributed to the lack of commercial offerings. Other reasons come down to investment priorities in new channels such as mobile. Whatever the reason, the lack of a behavioral database is one of digital media’s biggest missed opportunities. Here’s why.

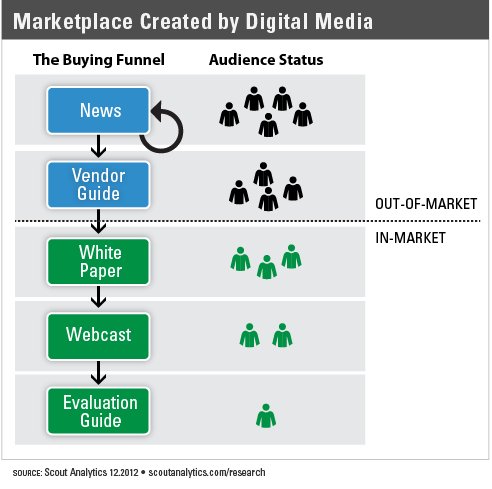

The primary role of digital media is as a marketplace to introduce buyers and sellers. Of course there are other purposes, but as measured by the percentage of revenue from audience versus advertisers, the linkage of buyer to seller is the dominant role. Consequently, a digital media brand has to be able to identify potential buyers for sellers. Is a potential buyer defined by a title in a certain size company within a particular industry? Maybe, but the truth is even if the advertiser’s target market was so tightly defined, only 10 percent of the titles are in market at any one time. Therefore, managing who is in market and for what reason optimizes revenue.

Consequently, the better definition of a potential buyer is an audience member who exhibits buying intentions (i.e., behaviors). With that definition, the only way to detect potential buyers is to make use of a behavioral database to analyze and understand behaviors within the buying funnel.

Now contrast the lack of behavioral databases in digital media with what advertisers are investing in: marketing automation. Marketers are constructing huge databases about their prospects and customers in order to assist in understanding buying behavior, architect customer acquisition funnels and optimize spending and revenues.

Marketers are becoming hugely data-driven, moving beyond simple cost-per-lead metrics into areas such as revenue attribution by funnel and marketing asset, conversion rates at each step in a funnel, and funnel performance over time. And the more options marketers have to reach potential buyers (e.g., social, search, content marketing, press, events), the more behavioral data-driven they become.

To stay relevant in this world, digital media has to be more behavioral data-driven than the marketers themselves (i.e., their customers). Digital media brands need to be able to quickly and easily identify funnels and buyer activity within their own media. Only then can they segment their audience members to be in or out of market for different advertisers. Only then can they help marketers construct high-performance funnels and earn high margins.

A digital media company should be able to answer the following questions for advertisers:

- What are the correlations between specific media topics and conversions?

- What types of content (e.g., white papers, evaluation guides, etc.) create more conversions than others?

- How many audience members are in market at any one time?

A digital media brand with a behaviorally data-driven approach creates a virtuous revenue cycle for itself. The more a digital media brand knows about what its audience is in market for, the more the digital media brand knows how to service each audience member. Guess what? Audience engagement increases. Audience size increases. Digital media brand value grows with advertisers as conversion rates increase. Up go the revenues.

Digital media companies definitely face huge challenges in developing profitable and sustainable revenue models, but the foundation to that model is a marketplace that benefits the buyer and seller. Without understanding the correlation between media consumption behaviors and buying behaviors, digital media brands are missing the real opportunity.