Posted by: Matt Shanahan

In the debate about business models for digital publishers, the cost of audience impressions is often underestimated. The expense to create a sellable inventory of impressions requires more than content production, it also includes the cost of audience development, which can greatly exceed the cost of content production. The classic example of this content vs. audience cost dynamic is “The Blair Witch Project” movie. “The Blair Witch Project,” whose final production budget was somewhere between $500,000 and $750,000, cost over $25,000,000 to market.

As the competition for audience impressions increases, the sophistication and cost of acquiring audience impressions is also increasing. This leads publishers to decide whether the return on investment from acquiring more fly-by impressions is greater than the cost to create more fan impressions. For example to compete for fly-by impressions with Demand Media, a publisher would have to build an entire SEO analytic and content platform to acquire impressions delivered from Google and Bing. Another example is to compete with the Financial Times for fan impressions of the international business audience, a publisher would have to build and promote a brand which has higher quality, more engaging journalism than the FT. Because the two approaches are expensive, a publisher is forced to trade-off investment in developing fans vs. acquiring fly-bys. This is the choice between building loyalty or building scale.

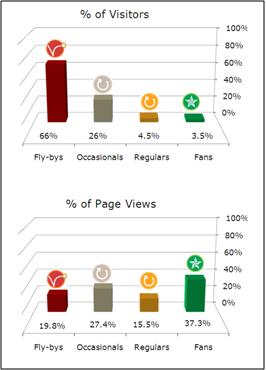

Not only do fans deliver more impressions, the impressions themselves are more reliable and valuable as well. Fans have great lifetime value. Together with the regulars and occasional, they typically make up only 33% of the audience but over 80% of the revenue. That is why many publishers have loyalty (i.e., building a brand and fan base) rather than scale as the top priority.

The dynamic of fans and fly-bys are central to the debate on business models for digital publishing (e.g., cost structure, paywalls). As witnessed by the recent debate about The Times of London, the industry is at odds. Is a publisher viable without an advertiser’s desired scale? Do fans bring additional revenue streams to publishers? If so what? Should fans bring higher advertising revenue to a publisher? If so how much? What is the true value of a fly-by impression?

Advertisers, agencies, and ad networks require scale and depend on targeting fly-bys across publisher properties. Publishers know that monetizing fan engagement is the basis for a sustainable business model and are looking to diversify away from commodity ad revenue. The tension in the industry is the tension between the priorities of loyalty and scale.